Risk of Recession has risen

Last Week in Review: Yield Curve Inversion Discussion

Posts by

Last Week in Review: Yield Curve Inversion Discussion

Last Week in Review: Thinking Like an Investor

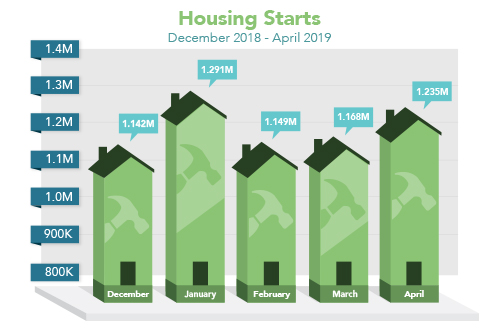

Last Week in Review: Goldilocks Scenario for Housing Continues...

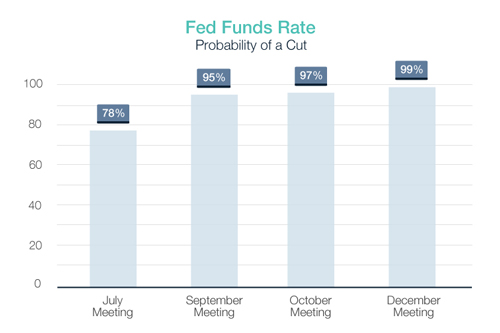

Last Week in Review: Fed cuts and home loan rates

Last Week in Review: US/China uncertainty

Last Week in Review: Americans favor owning

The holidays are almost here, but are you financially ready? If you have equity in your home, you may be able to convert it into cash. Many homeowners are taking advantage of low cash-out refinance rates to avoid accumulating further debt, giving themselves and their families the gift of financial flexibility.

Going through the mortgage process involves a lot of questions that can sometimes seem invasive… and yet, some of us share the intimate details of our lives across social media through our online presence with strangers all across the Internet. Guess where a lender might learn more about you?

Once you’ve made it through pre-approval, your house search, making your offer and securing your loan, it’s time to prep for the last step: closing! Unfortunately, closing brings with it another round of costs – some of which may feel like they’re breaking your personal bank. It’s time to look at how to reduce closing costs.

No doubt about it, applying for a mortgage can be a long and involved process that can leave you feeling drained and financially exposed. But it’s in your best interest to be transparent with your finances during this part of the home buying journey, particularly if you have issues that might hinder your loan approval. There are a number of credit issues that may affect your application for a mortgage loan; however, most of the challenges can be overcome.