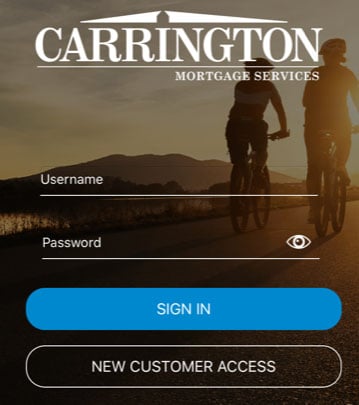

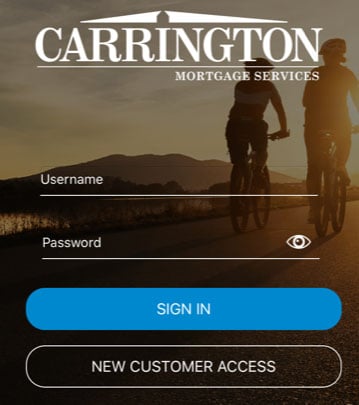

Easy Payments via our Mobile App

Using Carrington Quick Pay™ is a fast, easy, and secure way to make your Carrington mortgage payment. With our mobile app, you can make your payment in one swipe.

Posts about:

Using Carrington Quick Pay™ is a fast, easy, and secure way to make your Carrington mortgage payment. With our mobile app, you can make your payment in one swipe.

While it is true that student loan debt impacts many parts of your life, it does not entirely impact your choice to obtain a mortgage. According to Student Loan Hero, 44.2 million Americans have student loan debt. You may be wondering, how exactly do student loans affect the mortgage process? On the downside, the more loans that you have, the harder it may be to afford a home. Don't worry, paying attention to these factors will increase your chances of obtaining a home:

Improving your credit score is worth the time and effort, but that does not mean the result is going to be instantaneous. Credit improvement is a process and the best way to improve it is to manage it responsibly. If you are looking for ways to improve your score, here are some tips that you can utilize to begin the process:

Going through the mortgage process involves a lot of questions that can sometimes seem invasive… and yet, some of us share the intimate details of our lives across social media through our online presence with strangers all across the Internet. Guess where a lender might learn more about you?

Once you’ve made it through pre-approval, your house search, making your offer and securing your loan, it’s time to prep for the last step: closing! Unfortunately, closing brings with it another round of costs – some of which may feel like they’re breaking your personal bank. It’s time to look at how to reduce closing costs.

You’re now the proud owner of a mortgage – congratulations! But do you know what your mortgage payments include, and everything that goes into making up that monthly payment you’ll be making for the life of your loan (or until you decide to sell)?

There are plenty of aspects that surround the home buying journey that are out of your control. One of the areas where you can actually influence the outcome with your mortgage lender is having a strong financial status. The more you can do to make yourself an attractive candidate for a loan, the better chance you have to get a lender to approve you – and these are things that can help you get the best rate, terms and assists with making you a preferred candidate.

No doubt about it, applying for a mortgage can be a long and involved process that can leave you feeling drained and financially exposed. But it’s in your best interest to be transparent with your finances during this part of the home buying journey, particularly if you have issues that might hinder your loan approval. There are a number of credit issues that may affect your application for a mortgage loan; however, most of the challenges can be overcome.

There are so many things that can impact your ability to get a mortgage, and the rate and terms of that mortgage. Your credit history, your debt-to-income ratio, your job… and while you might be thinking that having a job is obviously important, there’s another job factor that can affect your mortgage: your commute. Long commutes can sometimes delay or derail a mortgage approval.