Credit Scores Galore!

We kicked off 2023 with our credit score mini-series where we covered the components that make up your score and are back with more!

In a rising interest rate market, it’s time to focus on controlling the controllable by improving your credit score. This will help save you money in the form of lower interest rates when applying for new credit.

Let’s take a deeper look into ways to use this knowledge and begin boosting that score.

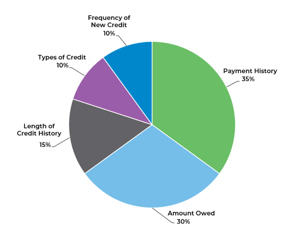

Set up AutoPay. “Payment History” makes up the largest percentage of your score, therefore, paying your bills on time is at the top of the list when discussing ways to improve your credit. The easiest way to ensure all of your payments are made on time is to setup AutoPay for all of your bills through your bank’s bill pay service, or directly through the website for the service you’re using.

Pay down balances. The next area to address is the “Amount Owed” section. Try to reduce any high-interest debt first, to save money in the long run. Keeping your credit card balances low compared to the amount of available credit shows lenders that you use credit responsibly and, over time, results in a higher score.

Keep old accounts open. “Length of Credit History” is next in line as you work your way to a higher credit score. Your credit history does not magically disappear so there is no point in closing accounts in an attempt to get derogatory marks off of your report. Keeping accounts open with low balances demonstrates reliable use of credit over time.

Limit opening new cards. It is a best practice to only open new lines of credit when you need to. Keeping this in mind will aid in improving the “Types of Credit” and “Frequency of New Credit” components of your score.

When you apply for new credit, a hard inquiry appears on your credit report which deducts a few points from your score. You have a 30-day period to shop for any “like credit”, meaning credit for a house (mortgage loan) or credit for a car (auto loan), to allow time to research your options and compare rates. It’s important to compare rates and only take on credit when necessary, as taking on credit with a higher interest rate will cost more money over time.

Improving your credit score takes time, you got this. Have patience and stick with it! Remember, the most important factors in improving your credit score are making payments on time and keeping your balances low. Stay tuned for more content surrounding credit scores as we continue to partner with you throughout your homeownership journey!