Benefits of Servicing with Carrington

Here at Carrington, we want to set you up for success on your homeownership journey. From home equity tools to paperless billing and AutoPay, here are some resources to help you streamline your homeownership needs.

HomeAmp

We believe that your home is one of your greatest assets, so we’ve created a tool that lets you explore what your home can do for you. Customized to your home, HomeAmp shows your estimated home value* and provides access to opportunities, lending products and even discounts that could help you achieve your future financial goals. You can access HomeAmp by logging into your account at CarringtonMortgage.com.

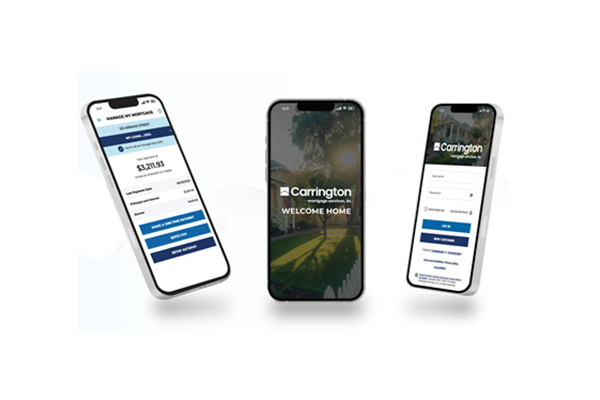

Mobile App

To make your homeownership experience more convenient, we released a new mobile app last year to manage your mortgage at your fingertips. Enjoy access to your personalized account, see estimated home equity and take advantage of additional mortgage resources anywhere, anytime. You can also see your loan summary and payment history, make easy payments or set up AutoPay via our mobile app! Download today on the App Store or Google Play store.

Go Paperless

With Carrington’s Go Paperless program, you don’t have to wait for access to important account documents or statements to arrive in the mail. They're right where you left them, safely on our secure website or within your mobile app; ready whenever you need them. These paperless statements contain the exact same information your paper statement would—but now information is immediately at your fingertips!

You can update your preferences at any time by following these steps:

- Log into your account at CarringtonMortgage.com

- Click "Manage Alerts" in the top menu

- Click the green "Go Paperless" icon on the left side of your screen

In your mobile app, you can easily toggle "Let's go paperless!" on or off with one click under the "My Documents" section. Please note that by choosing to go paperless in the mobile app, you are selecting the paperless option for all your documents, not just one.

AutoPay

When you’ve got a lengthy list of bills to pay every month, it’s easy to forget one and have it fall to the wayside. With Carrington’s AutoPay feature, you can choose from a few different options that will help you stay on track with your payments each month, including monthly, semi-monthly or bi-weekly automatic payments. Read more about flexible AutoPay options and benefits here; and when you’re ready to set up AutoPay, get started by logging into your account at CarringtonMortgage.com and clicking "AutoPay." If you're eligible for AutoPay, our mobile app allows you to choose "Set Up AutoPay" in the menu directly from your phone! All you need to do is enter your financial institution's information, along with your scheduling choice for payments.

Setting up Your Alerts

Carrington email and text alerts help you stay on top of everything related to your loan. You can avoid late fees with a helpful monthly payment reminder, set up notifications to update you whenever there are important changes to your account and so much more. Our alerts are quick and easy to manage. All you need to do is log into your account and visit the “Manage Alerts” section, or choose "Manage Alerts" from the menu on the mobile app. In the mobile app, you can turn on text and email alerts as well as select "App" to receive push notifications.

Affordability Lending Options for Homebuying

As the housing market evolves, new opportunities for affordability have emerged, offering prospective homebuyers greater flexibility in achieving their homeownership dreams. You can explore some options that have come to the forefront recently, including the 40-year mortgage and temporary buydowns.

As you can see, Carrington has a wide variety of options that make homeownership simple and attainable, all while tailoring solutions to your customized needs! For more details on all the services we provide, contact us today.

* Estimated Home Value is an estimated value based on a combination of multiple available data sources. These data sources include but are not limited to: The Federal Housing Finance Agency House Price Index (FHFA HPI®), the borrower's original purchase price, length of time from the original purchase, and other additional factors. It is only an estimate and is subject to change. The value estimator is not a substitute for the expertise of a licensed real estate agent or appraiser and should not be relied upon as a substitute for an appraisal.