All-Time Low Home Loan Rates

Last Week in Review: All-Time Low Home Loan Rates

This past week, Freddie Mac reported the 30-year home loan rate hit an average all-time low of 3.15%.

As the unofficial start of summer has begun and states continue to reopen, this is welcome news, but there is even more to the story.

- Refinance activity remains elevated and with the average refinance loan amount declining, it means many borrowers with smaller loan amounts are able to lower their interest rate expense. This can be a positive economic contributor in the months ahead.

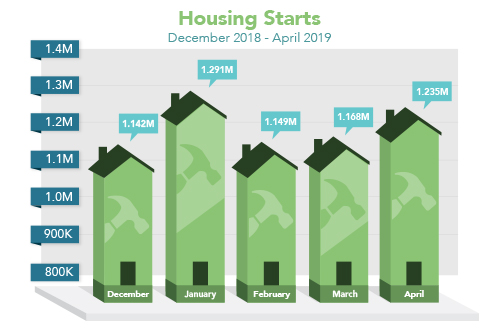

- Housing demand has increased sharply over the past couple of weeks and the low interest rates have been a contributing factor.

There was a lot of bad economic data this past week, but most of it was backward-looking. Within Weekly Initial Jobless Claims was continuing claims, a ray of sunshine and a leading indicator of labor market strength.

Last Thursday, nearly 4 million more people than expected came off unemployment benefits — meaning people are finding work or have gotten rehired. We are watching to see if this trend continues as the U.S. economy continues to reopen.

Bottom line: With rates at all-time lows, housing demand remaining strong, people going back to work, and optimism rising, we should expect the housing market and broader economy to continue to improve and ultimately thrive in months ahead